Are gift cards taxable?

The short answer: yes, gift cards from an employer are usually taxable. Whether you send gift cards to full-time employees or independent contractors, the IRS considers gift cards to be cash equivalent.

As a result, gift cards from employers sent as a holiday gift or a gesture of appreciation are included under the umbrella of taxable income.

We’ll give you a basic run-down of how and why gift cards are taxable, as well as exceptions. But consult a tax professional if you have questions about taxes — this is not a substitute for their advice.

What are the IRS rules on gift cards?

In the context of the IRS, "cash equivalent" is the value given to non-cash benefits or perks that employees get as part of their compensation.

The IRS considers these non-monetary benefits as if they were paid in cash, and their cash equivalent value is used to calculate the employee's taxable income.

With gift cards, it’s pretty simple: the “cash equivalent” value is just the dollar amount on the gift card.

There are a bunch of things that workers can get from their employers that the IRS considers cash equivalent, and therefore taxable. Here are a few common examples:

Fringe benefits: Think employee stipends or a company car. The IRS requires employers to assign a cash equivalent value to these benefits, which is added to the employee's overall income.

Gift cards or prizes: If an employer provides gift cards or non-monetary rewards, the IRS requires the employer to determine the cash equivalent value of these items. This value is then treated as additional income for the employee.

Imputed Income: In some cases, employers might provide certain benefits that are considered taxable, even if they’re not given in cash form. This imputed income is assigned a cash equivalent value. Imputed income includes things like health insurance for non-dependent domestic partners, excessive life insurance coverage, and educational assistance above $5,250.

So while it’s a pain that gift cards are taxable, keep in mind that if you give your employees a different kind of gift, it’s likely taxable too according to the IRS.

Comparatively, de minimis fringe benefits are not taxable.

De minimis fringe benefits are something offered to an employee that are of little value, and therefore not taxed. This includes free in-office snacks and drinks, or small gifts like flowers, candy, or books. It also includes larger, one-off items like event tickets or free meals given during work hours.

Do tax rules for gift cards change based on the amount on the card, or the purpose of the card?

The tax rules for gift cards do not change based on the amount. Gift cards are taxable whether they’re worth $50 or $500.

The tax rules are also consistent whether the gift card is offered as part of an employee recognition program or as a holiday bonus. It’s still considered cash equivalent.

There is an exception: if you send employees a gift card for an expense incurred as part of work, it isn’t considered taxable income. Examples include:

An Uber Eats gift card for an at-home meal during a remote meeting

A Visa prepaid card to be used for per diem travel expenses

A gift card to an office supply store to spend on office equipment

Why send gift cards?

If gift cards are considered cash equivalent in the eyes of the IRS, why not just send cash or a physical item?

Gift cards have a couple of advantages over other gifts or tokens of appreciation.

For one, they’re more trackable and easier to deliver than gift baskets or other physical items. If you’re using an incentives and rewards platform like Tremendous, you can send gift cards instantly and confirm delivery within the dashboard.

They’re also more festive and personal than simply adding money to an employee’s paycheck. A digital or physical gift card with a personalized message around the holiday season (or after a particularly stellar quarter) feels special and distinct, while an extra $50-$100 tacked onto an employee’s paycheck may go unnoticed entirely.

Plus, if you’re using a platform like Tremendous, you can allow the recipient to redeem the gift card however they want. They can redeem their reward as a direct deposit if they’d prefer money straight to their bank account, or as a gift card to one of over 1,000 retailers for a guilt-free treat.

Gift card taxes based on recipient

Tax rules fluctuate depending on who’s receiving the gift card and their relationship to your business.

Depending on the recipient, there are slightly different things to look out for (and forms to fill out). You’ll have to fill out different forms for full-time employees vs. part-time employees, for example, and different rules apply for gift cards sent to clients vs. research participants.

We’ll run through the basic rules to keep in mind for each demographic.

How are gift cards taxed for full-time employees?

If you send gift cards to full-time employees, there are a couple of forms where you’ll need to report the gift.

Inclusion on W-2 form: The value of the gift cards is typically included in the employee's Form W-2, which is the employer's annual wage and tax statement. This form outlines the total compensation, including cash and non-cash benefits, the employee received during the tax year.

Income tax withholding: Income tax withholding is applied to the value of the gift cards, just as it is for regular wages.

Potential state and local taxes: Depending on state and local tax laws, employees may also be subject to additional taxes on the value of the gift cards.

What is a tax gross-up?

Want to give employees a gift without adding to their tax burden? It’s totally doable. In fact, most payroll platforms have this capability built in.

Here’s how a tax gross-up generally works:

Identify the taxable benefit: Determine the value of the non-cash benefit or perk considered taxable. With a gift card, this is simply the dollar amount on the card.

Determine the applicable tax rates: Consult a tax professional to understand the relevant federal, state, and local income tax rates that apply to the taxable benefit. Different jurisdictions may have varying tax rates.

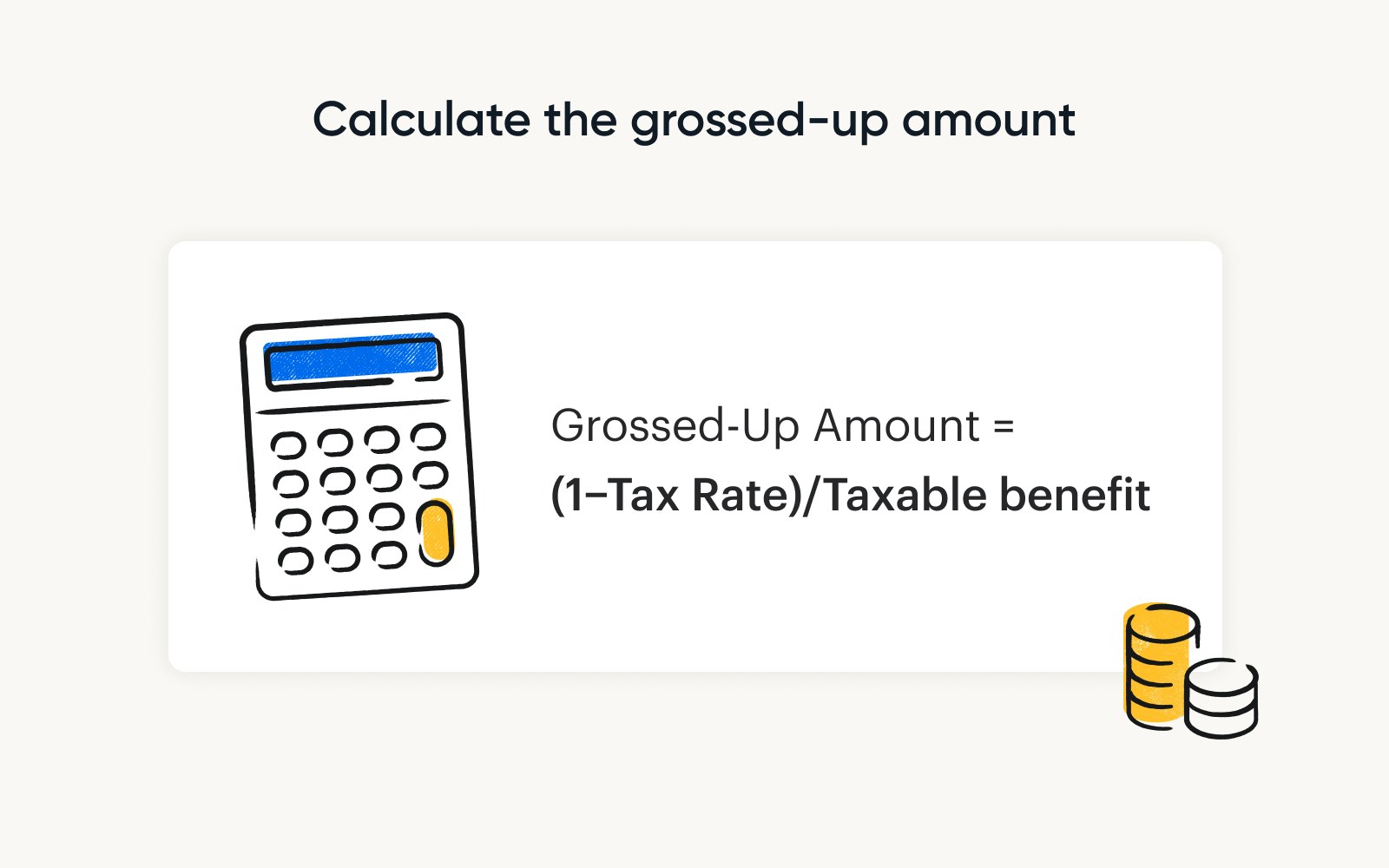

Calculate the grossed-up amount: Calculate the grossed-up amount using the following formula (or search for a gross-up calculator, there are many out there):

This formula accounts for the taxes that will be deducted, ensuring that the recipient receives the intended net amount.

Confirm the gross amount: The grossed-up amount represents the total compensation before taxes. Confirm that this amount aligns with your intended gross compensation for the employee.

Withhold taxes: Withhold the appropriate amount of taxes from the grossed-up amount. This ensures the net amount aligns with the employee's expected after-tax income.

Report on tax forms: Include the grossed-up amount on relevant tax forms. For employees, this might involve reporting the adjusted compensation on Form W-2.

How are gift cards taxed for independent contractors and part-time employees?

If you send gift cards to independent contractors or freelancers, they must fill out a W-9 rather than a W-4. Then, in the new year, you’ll send them a form 1099 for the prior tax year.

There are instances where you’ll need to collect W-9s from individuals who aren’t technically independent contractors.

If you’ve sent $600 or more in gift cards or incentives to individuals as payment for participating in research, testing a product, referring customers to your business, or other services, you’ll need to send them a 1099. (More on research participants below.)

How are gift cards taxed for non-employees, like clients?

If you’re sending gift cards to clients to thank them for their loyalty, or to research participants as an incentive, you also need to be aware of the tax implications of gift cards.

Tax rules differ, depending on who you're sending money to. You don't have to report on gift cards sent to clients, but you do have to worry about gift cards sent to research participants.

For clients

You don’t have to worry about reporting on gift cards sent to your clients. In fact, they’re actually tax-deductible (to a certain extent).

The IRS states you can deduct all or part of the cost of gifts you send to friendly businesses or clients, but only up to $25 per person.

Gifts worth $4 or less that have your company name engraved on them don’t count toward this $25 cap, if you give them out on a regular basis. (Basically, cheap company swag doesn’t count.)

Incidental costs like engraving, packing, or shipping aren’t included in the $25 limit if they don’t add substantial value to the gift.

One exception is entertainment. So, tickets to a game or a show aren’t deductible, (You don’t have to send your clients a 1099 either.)

For any gifts to clients to be deductible, you need to have records proving the business purpose of the gift and details of the amount spent.

For research participants

If you send incentives to research participants for completing surveys, participating in usability studies, or offering any other kind of feedback to your business, stay on the lookout for the $600 tax threshold.

The $600 threshold is the point at which research incentives become reportable.

While payors won’t need to report giving a $15 incentive for filling out an online survey, they will need to report if they give $600 or more to a single person in a calendar year.

This is one of the many reasons to avoid using the same individuals repeatedly for your research studies.

Giving someone a $100 incentive is hassle-free. But giving the same individual six $100 incentives can become a bit of a pain come tax season.

If one of your research participants crosses the $600 tax threshold, you’re responsible for collecting W-9s and sending participants a 1099. (See the next section for how Tremendous can help with this.)

It’s very possible your potential research participants aren’t aware of this threshold, so it’s best to let them know the tax ramifications of racking up too much in incentive earnings before they sign on to your study. Especially if you’re sending them a hefty incentive for their time.

How Tremendous can help streamline tax reporting

If you send payouts, incentives, or gift cards through Tremendous, tax season can be a bit less stressful.

We can automatically collect W-9 forms during the reward redemption process if you’ve sent more than $600 to a single person with a US IP address. However, there are edge cases where companies may have to collect or manage W-9s on their own.

Any data collected for the W-9 is downloadable from your account. Go to ‘Billing’ → ‘Tax Documents’, and select the appropriate tax year.

This makes tax season less hectic. And it ensures all recipient tax forms are available and retrievable from a single dashboard.

Planning to send employees gift cards for the holiday season, or a job well done? Sign up today or chat with our team.